Brilliant Tips About How To Improve A Fico Score

High outstanding debt can adversely affect a score.

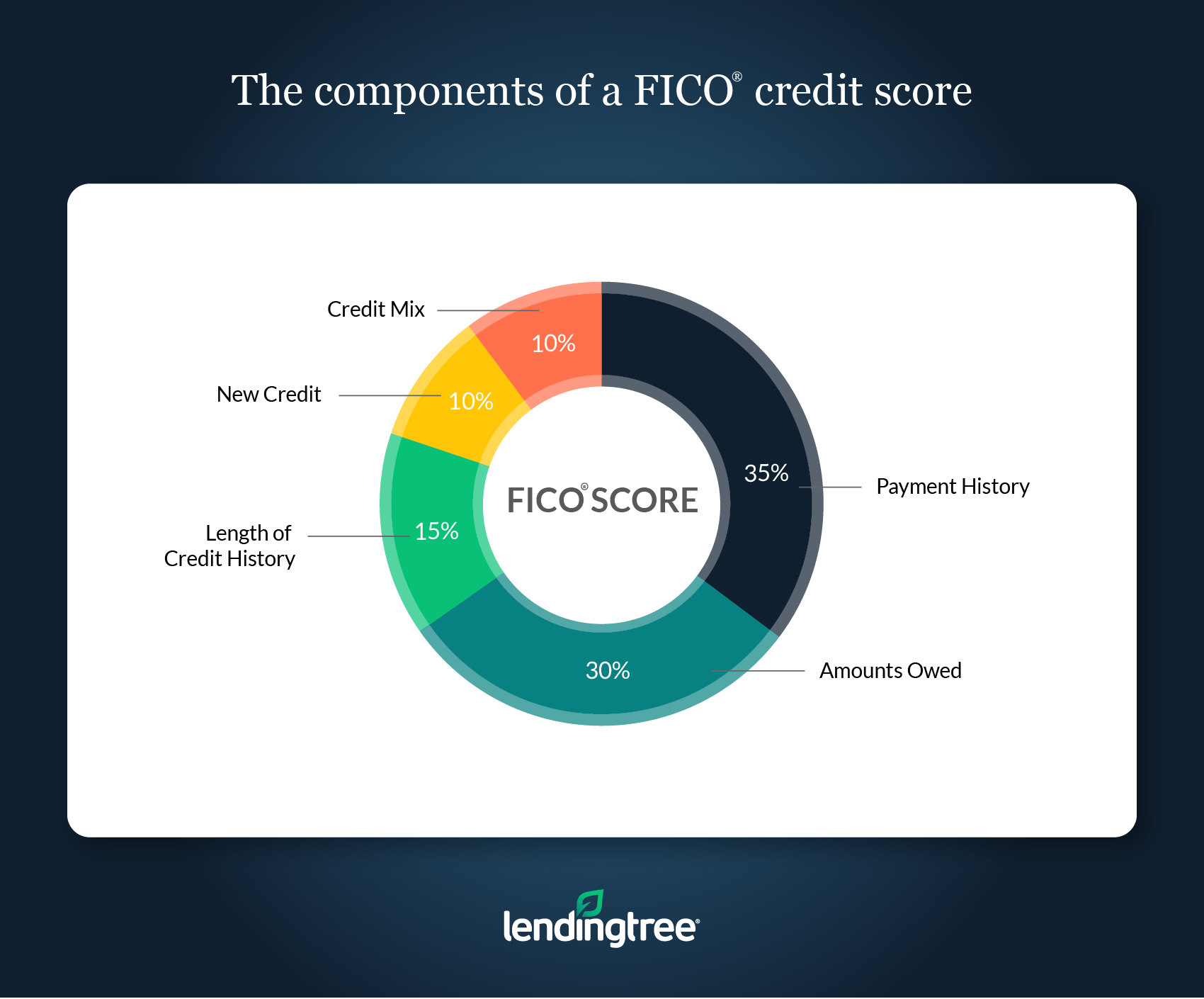

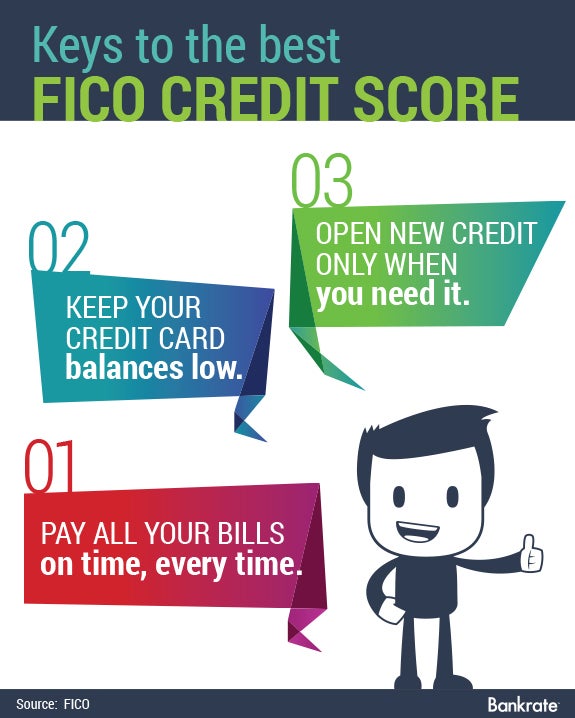

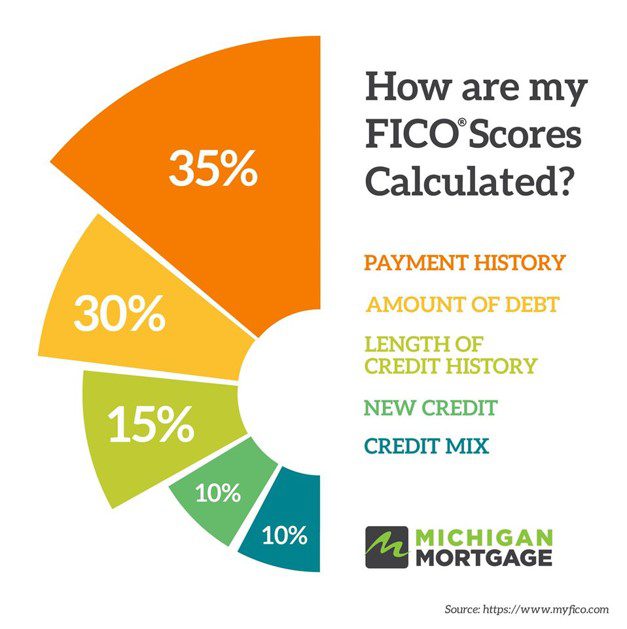

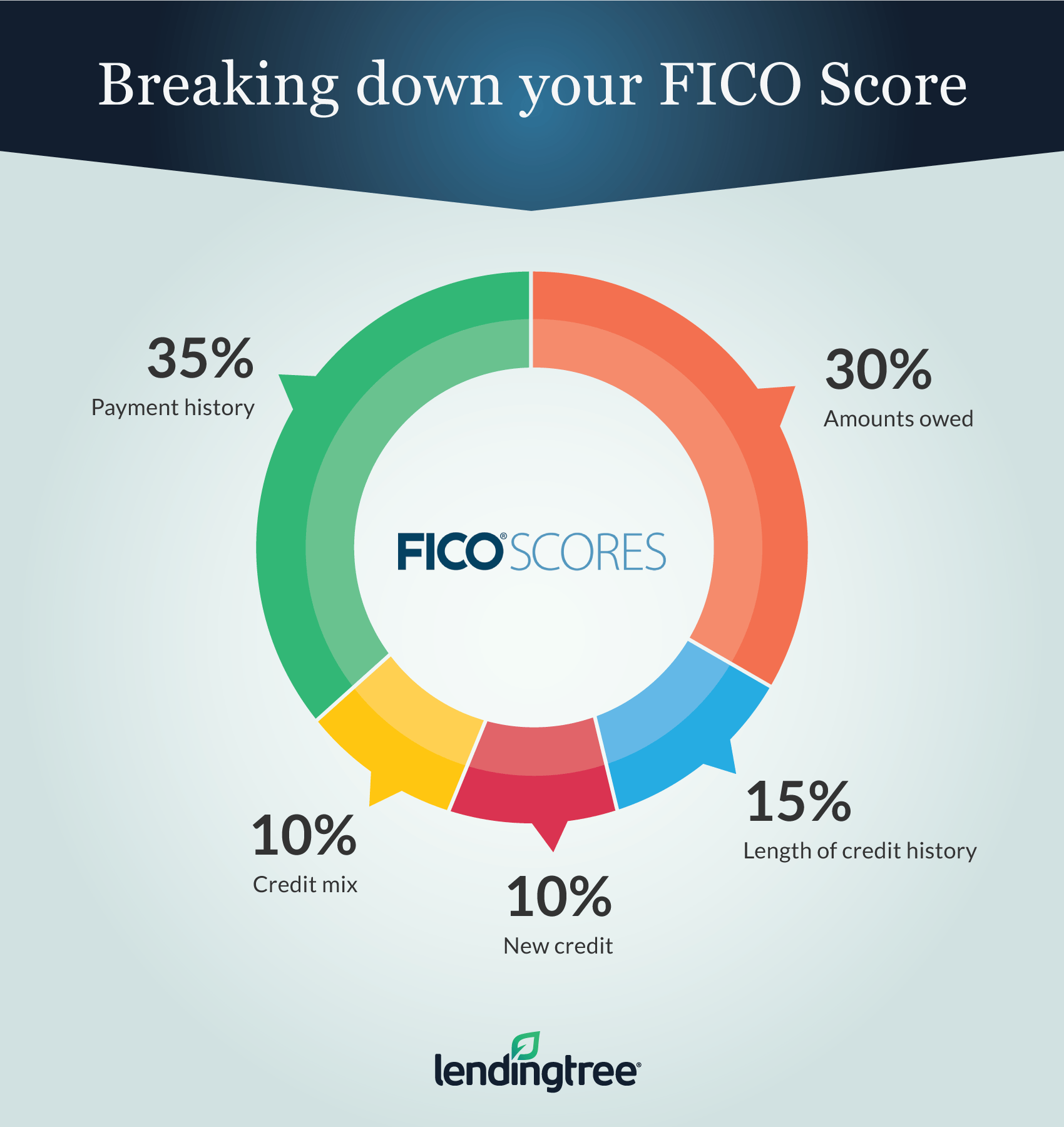

How to improve a fico score. Your payment history has the largest impact on your fico score at 35% of your overall. Even one bill that you pay more than 30 days late can drag your fico score. Seven ways to improve your fico score 1.

Make a list of debts and prioritize repayments by interest rate. Aim for 30% credit utilization or less credit utilization refers to the portion of your credit limit that you use at any given time. The single most important thing you can do to increase fico score is to make your payments on or before their due date.

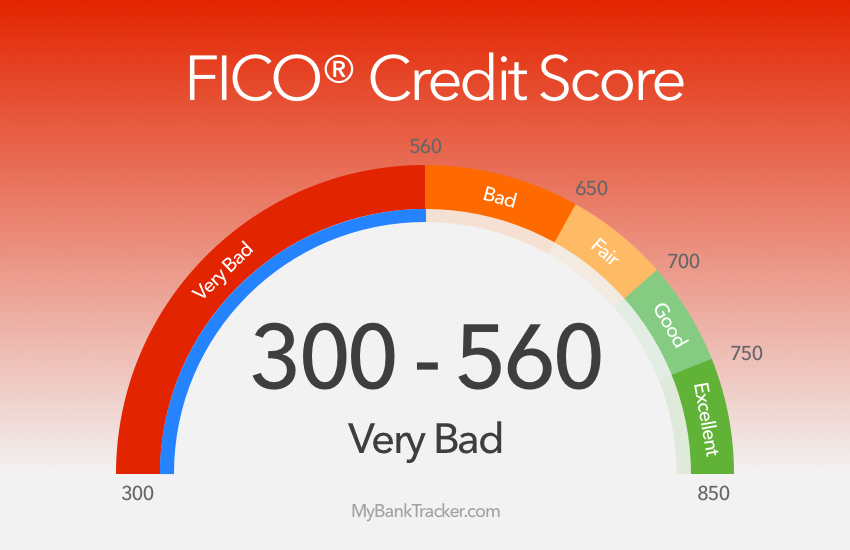

Instead, the lowest possible credit score you can have with either model is 300. You can improve your credit score by paying off existing debt. Redraw your budget (you do have a budget, don’t.

Raise your credit scores instantly by paying your utility & phone bills on time. If you have no credit history at all, then. Ad improve your fico® score & get credit for the bills you're already paying.

Since your fico® score is constantly changing as you pay your monthly bills and take on new lines of credit, there are always opportunities to improve it. A score of 850 is the highest score you can achieve. Late payments more than 29 days will severely.

While these numbers serve as a baseline, those in the business of credit feel the answer is not so. Best ways to increase your fico score 1. That is, you should maintain a balance of no more than $3,000 on a credit card with a limit of.

:max_bytes(150000):strip_icc()/dotdash_final_800_Plus_Credit_Score_How_to_Make_the_Most_of_It_Dec_2020-01-eab02cc511db4ce19ab3c1869e750d3b.jpg)